Americans Have Serious #Goals to Improve their Credit Scores

Chase Slate® 2017 Credit Outlook finds adults taking steps to improve their credit

WILMINGTON, DE Oct 10, 2017 Americans are tracking their credit health just in time for Credit Awareness Month, according to the Chase Slate 2017 Credit Outlook. They are taking steps toward managing their credit scores on a regular basis.

"Americans are more ambitious and action-oriented toward their credit health. They are not only expressing a desire to improve their credit scores, but also creating and carrying out specific strategies to achieve their goals."

Mical Jeanlys, General Manager of the Chase Slate credit card

Here’s what Slate uncovered:

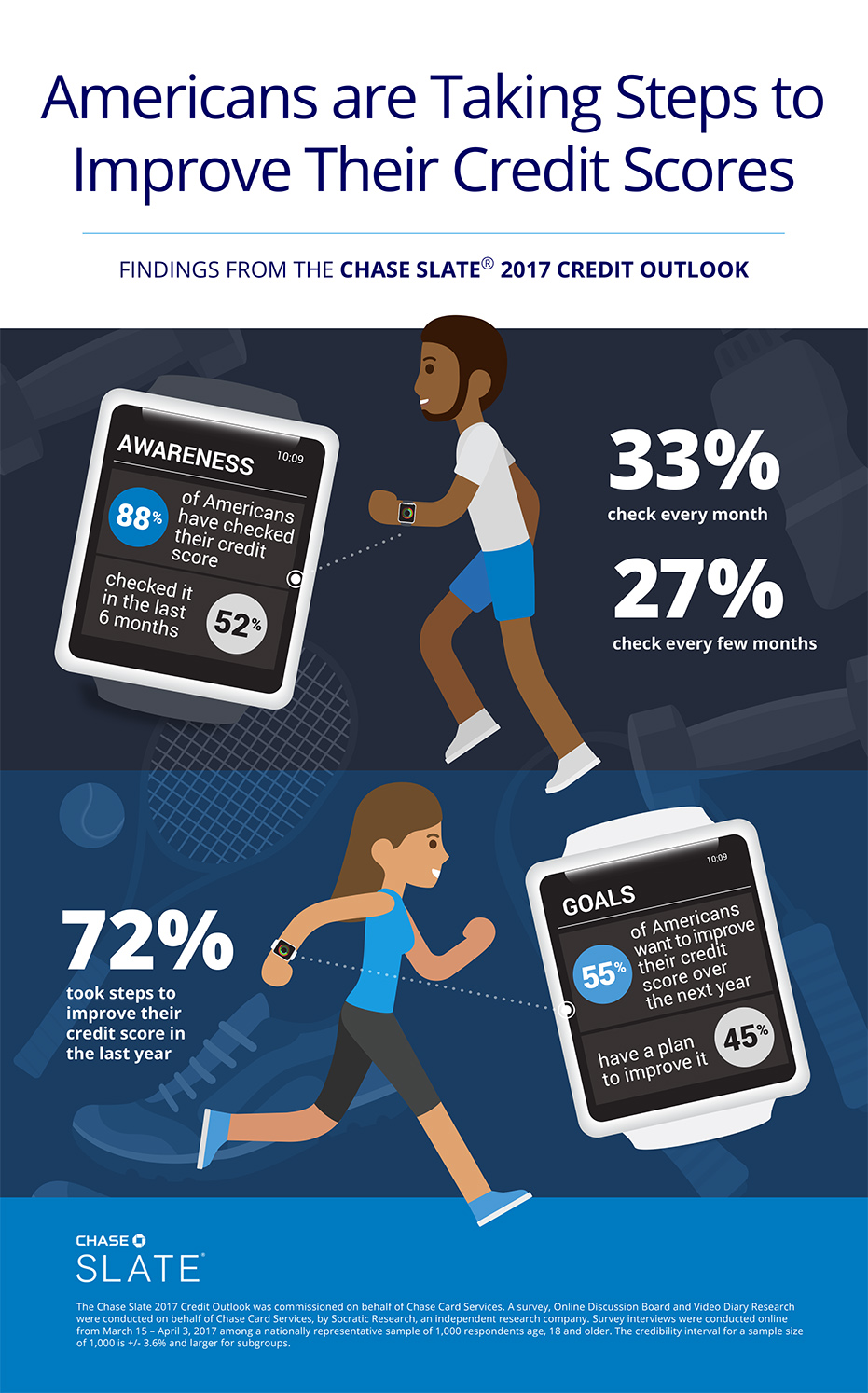

- 72% have taken some steps to improve their credit score in the last year.

- 88% have checked their credit score, and more than half (52%) have done so in the last six months.

- Of those who have checked their credit score, 33% check every month, while 27% check every few months.

- 55% would like to improve their credit score over the next year, and nearly half (45%) have a plan to improve their credit score.

Read Americans Swipe Left When it Comes to High Credit Card Debt

About Chase Slate

With no annual fee, no penalty APR and tailored insights into your credit behavior, Chase Slate empowers cardmembers to manage their finances wisely now and in the future. Through the Chase Slate Credit Dashboard, cardmembers receive access to their FICO® Score, the top positive and negative factors impacting it and tips for improving their credit health overtime for free every month. The feature is available to cardmembers online at Chase.com.

About the Chase Slate 2017 Credit Outlook Survey

The Chase Slate 2017 Credit Outlook was commissioned on behalf of Chase Card Services. A survey, Online Discussion Board and Video Diary Research were conducted on behalf of Chase Card Services, by Socratic Research, an independent research company. Survey interviews were conducted online from March 15 – April 3, 2017 among a nationally representative sample of 1,000 respondents age, 18 and older. The credibility interval for a sample size of 1,000 is +/- 3.6% and larger for subgroups.

Online Discussion Board interviews were conducted from April 18 – April 21, 2017 among 34 Millennials, ages 21-36, and the Video Diary Research interviews were conducted from April 26 – May 5, 2017 among 20 Millennials, ages 21-36. Both the Online Discussion Board and Video Diary Research were conducted nationally among Millennials who are recent or future homebuyers.