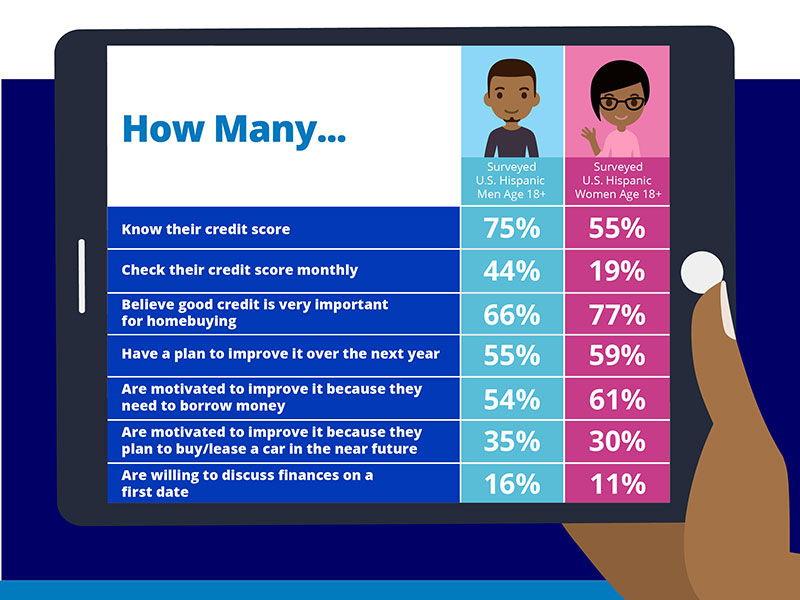

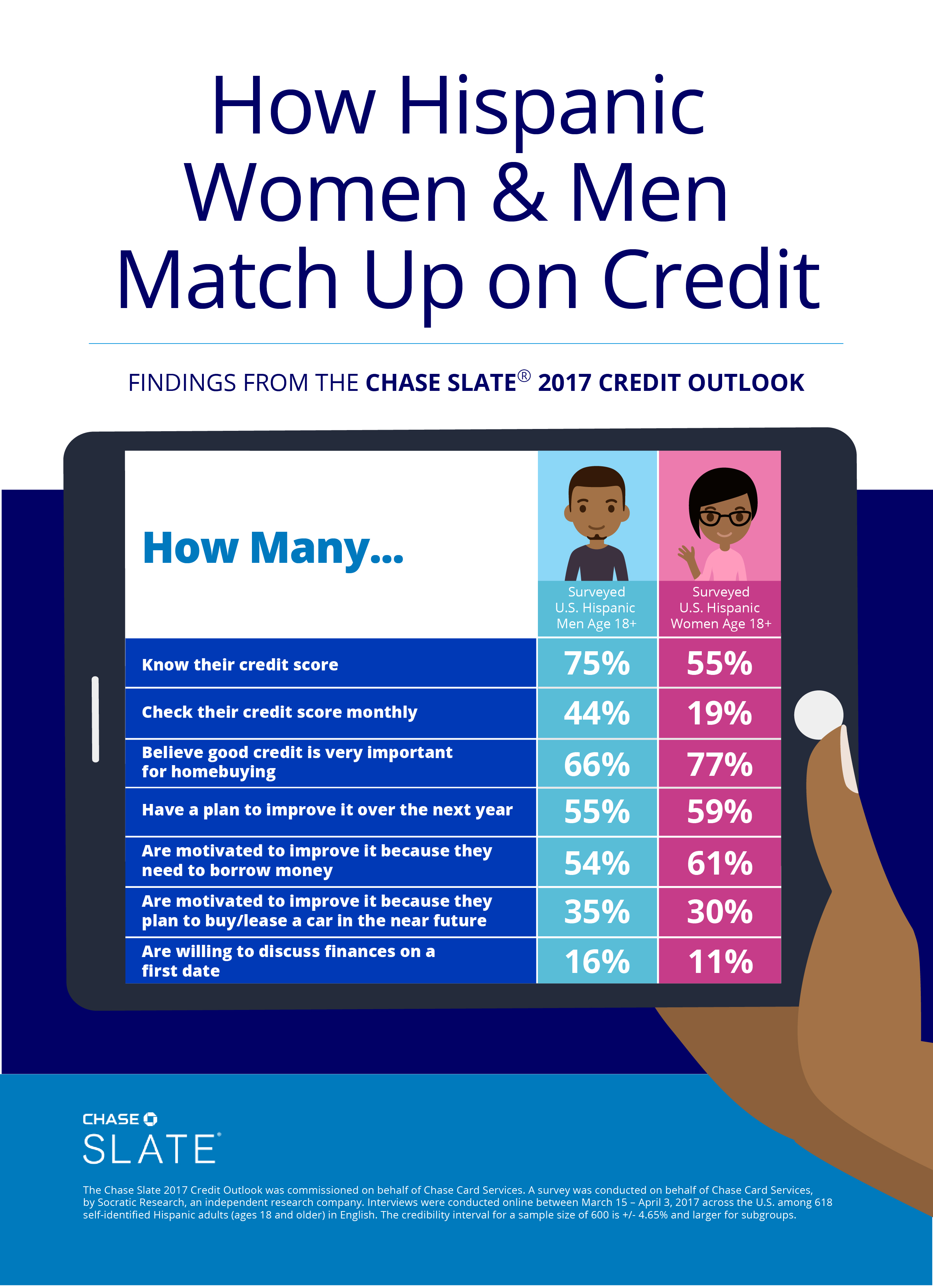

U.S. Hispanics Take Action to Improve Credit Health

@Chase Slate® Credit Outlook finds Hispanic Americans are more interested in improving credit scores and are developing plans to do so

WILMINGTON, DE Jul 13, 2017 While fewer U.S. Hispanics are satisfied with their credit score compared to Americans nationally (47% vs. 55%), more than half have a plan to improve their credit health, according to the Chase Slate 2017 Credit Outlook Survey.

“U.S. Hispanic adults are newer to credit and credit cards than U.S. adults overall, but they are diligent about checking their credit score and finding actionable ways to improve it,” says Mical Jeanlys, general manager of the Chase Slate credit card.

Of the U.S. Hispanics surveyed, Slate discovered:

- 88% have checked their credit score and have done so for tactical reasons (e.g. they want access to a loan or are planning to buy or refinance a home).

- 32% value positive financial behaviors in a potential mate and 27% think less of a significant other if his or her credit score was lower than expected.

- Millennials are more likely to have a plan to improve their credit score (66%) than Boomers (40%).

- 81% are more likely to have already taken at least one step to improve their credit score – compared to 72% U.S. adults – including setting reminders to pay their bills on time.

- 64% want their children to learn about credit.

“There is much optimism among Hispanics in this year’s survey about improving credit health,” said Certified Financial Planner™ and Chase financial education ambassador Brittney Castro. “I encourage everyone to learn about their finances and use tools to put a financial plan in action. A first step is checking their credit score and understanding the top factors impacting it.”

About the Chase Slate 2017 Credit Outlook Survey

The Chase Slate 2017 Credit Outlook was commissioned on behalf of Chase Card Services. A survey was conducted on behalf of Chase Card Services, by Socratic Research, an independent research company. Interviews were conducted online between March 15 – April 3, 2017 across the U.S. among 618 self-identified Hispanic adults (ages 18 and older) in English. The credibility interval for a sample size of 600 is +/- 4.65% and larger for subgroups.

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.5 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: 5,200 branches, 16,000 ATMs, mobile, online and by phone. For more information, go to Chase.com. For more information about Chase Slate, go to ChaseSlate.com. Also, Chase offers consumers the opportunity to monitor their credit score at no cost through Credit JourneySM