Consumer Banking

Forget the ‘Birds and the Bees’ Boomers Make ‘The Talk’ About Money #1

Thanks to parents, Millennials are bullish on retirement, finances

NEW YORK, NY Oct 17, 2016 Of course, Boomers had “THE Talk” about the “birds and the bees“ with their kids. But they put more value in having the “money talk” because they want to be much more open about finances than their parents were with them.

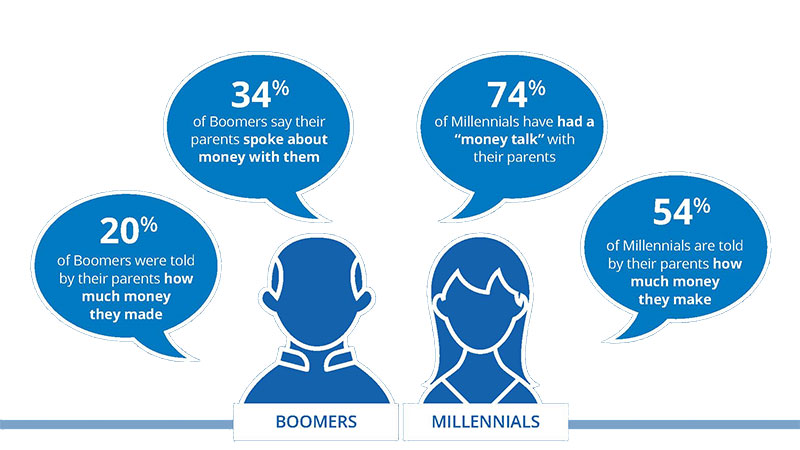

That has given the Millennial generation heightened awareness about budgets, greater financial confidence, and more ambition to retire earlier than the generations before them.

These findings emerged from a major study by Chase and Center for Research on Consumer Financial Decision Making at the University of Colorado. It examined the similarities, differences, and ramifications of how different generations discuss and feel about money.

The study also brought together pairs of people from different generations across the United States to talk about money, generating fascinating results:

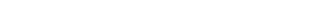

Parents of Boomers avoided talking about money; Millennials’ parents talked about it a lot

“Money Talk” Makes Millennials Bullish

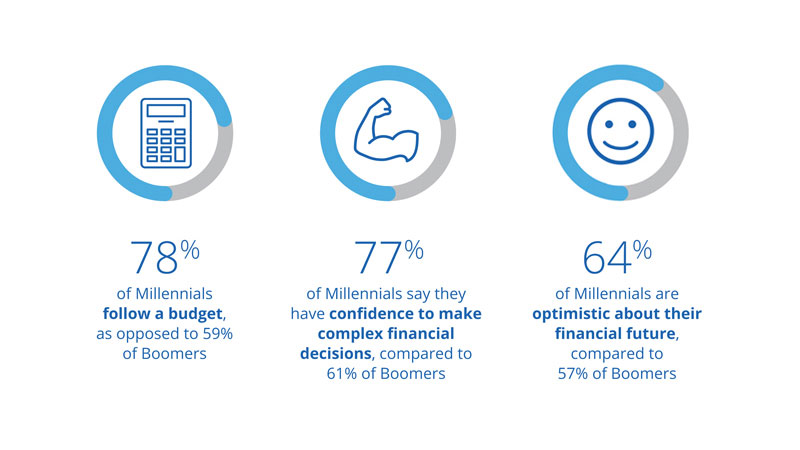

Millennials began socking away for retirement at age 23 – 17 years sooner than Boomers got going. They are much more confident in their financial decision making and are preparing for the future. In fact, Millennials are shooting to retire by age 60, almost a decade before Boomers.

Millennials Will Take It One Step Further

Inspired by their parents, Millennials plan to do their parents one better:

Most Millennials (82%) are comfortable talking to everybody about money, including family, friends and professional advisors

"We find that different generations have different family obligations and different willingness to talk money with other family members. Perhaps that is because Millennials are in tighter financial circumstances and need to talk with family members and others to cope."

Professor John Lynch, who directs the Center for Research on Consumer Financial Decision Making

Knowing more about each generation helps us provide financial advice with even greater relevance. Our findings reinforce the importance of having open and honest conversations about finances – no matter where you are in your life.

Peter Wall, Chief Market Strategist for Chase

The study was done in conjunction with a five-city social experiment that looked at generational views toward financial candor, confidence, retirement and the American Dream, a project called Generational Money Talks sponsored by Chase.

About the Chase and University of Colorado, Boulder Study

Chase commissioned an online survey about personal financial views and habits. The survey is among a nationally representative sample of 2,021 adults (18 years old and older) living in the continental United States with an oversample to obtain 200 respondents in the following cities: New York, Los Angeles, Chicago, Dallas, Phoenix, Columbus, Miami and San Diego. The survey was conducted between June 9th and June 17th, 2016 with a margin of error of +/- 2.18 percent at the national level and +/- 7.93 percent at the local market level with a 95% confidence level.

The Center for Research on Consumer Financial Decision Making conducts original scientific research and promotes dialogue among experts from academia, business, and government on the topic of how to help consumers make better financial decisions. www.colorado.edu

About the Social Experiment

Chase paired Millennials, Gen X’ers and Boomers who were complete strangers to discuss their finances in New York, Dallas, Miami, Chicago and Los Angeles. The live conversations focused on major life moments when significant financial decisions are often made - such as marriage and retirement. Additionally, in partnership with the University of Colorado Boulder’s Center for Research on Consumer Financial Decision Making, Chase commissioned a study to better understand what drives the financial goals, concerns and decisions of these generations through a national, quantitative survey.