Business Banking

Businesses Raring to Grow, If They Can Find Skilled Workers, JPMorgan Chase Survey Finds

The new tax law and recent regulatory reform boost expectations

New York, NY Feb 21, 2018 American business owners are feeling better than they have in years, thanks in part to recent regulatory reform, corporate tax cuts and a steadily improving economy. But they’re getting nervous about finding the skilled workers they need to grow as their older workers retire, according to the annual JPMorgan Chase Business Leaders Outlook report released today.

This trending positivity is confirmation that something real is happening in the economy. Business optimism translates to business activity, which is why we’re seeing increased expectations across the board. For businesses that can hire and retain talent in today’s tight labor market, there are growth opportunities to capitalize on.

Jim Glassman, senior economist at JPMorgan Chase

Businesses of all sizes are concerned about the supply of qualified candidates: 45% of midsize business executives are extremely or very concerned about it, as are 31% of small business executives.

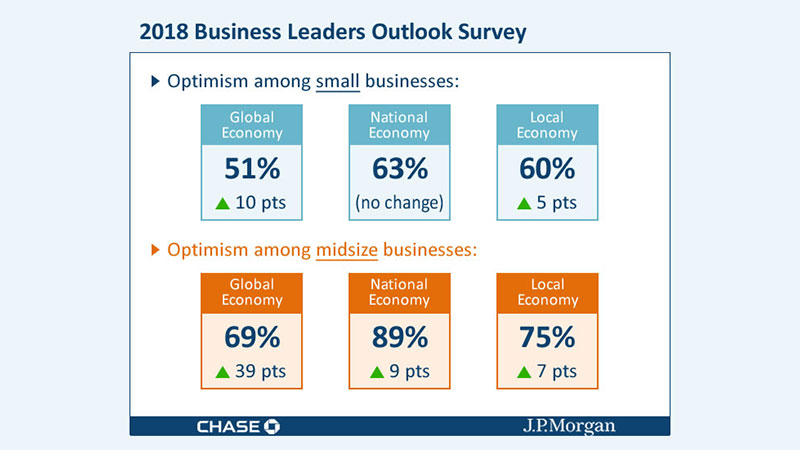

Among midsize businesses, optimism is up across the board, year over year:

- 69% are optimistic about the global economy, more than double last year’s sentiment and the highest since the survey began eight years ago

- 89% are optimistic about the national economy, up 9 points vs. last year

- 75% are optimistic about their local economy, up 7 points vs. last year

Among small businesses, optimism for the global and local economy is the highest it’s been in several years:

- 51% are optimistic about the global economy, up 10 points vs. last year

- 63% are optimistic about the national economy, consistent with last year

- 60% are optimistic about their local economy, up 5 points vs. last year

The new tax law is front and center for midsize businesses, with most (91%) expecting it to help their business. Only 37% of small businesses expect it to positively impact their business’s bottom line while almost an equal number expect no impact (30%).

With their tax savings, midsize businesses indicate they plan to:

- Pay down debt: 44%

- Invest in capital expenditures: 43%

- Increase wages: 33%

When it comes to hiring and pay, midsize businesses indicate they are also more likely to boost spending:

- Increase hiring of full-time personnel: 64%, up 7 points vs. last year

- Boost compensation: 76%, up 5 points vs. last year

Small businesses, meanwhile, indicate they are more likely to hold the line:

- No changes to full-time personnel: 65%, consistent with last year

- No change in compensation: 56%, consistent with last year

What midsize businesses are thinking about business expectations and challenges:

- They expect to increase sales (82%), profits (75%), capital expenditures (42%) and credit needs (30%), all up year over year

- Their top challenges for 2018 are:

- Increasing sales: 63%, down 8 points vs. last year

- Limited supply of talent: 54%, up 10 points vs. last year and increasing every year since 2014

- Managing labor costs: 50%, up 4 points vs. last year

- The most common reasons for the talent shortage are a lack of applicants (52%), unique skills needed (50%) and applicants’ work ethic (39%)

What small businesses are thinking about business expectations and challenges:

- Many expect an increase in sales (62%) and profits (59%)

- Their top challenges for 2018 are:

- Increasing sales: 54%, up 16 points vs. last year

- Taxes: 28%, consistent with last year

- Uncertainty of economic conditions: 27%, down 7 points vs. last year

- Likely reflecting recent tax reform, fewer small business executives would select lowering taxes as a top area for the government to focus this year: down seven points from last year and 11 points from 2016. Proposed focus areas growing this year: Create and foster a skilled workforce (23%) and improving infrastructure (36%) are all up vs. last year.

For more information on the survey, visit jpmorganchase.com/businessleadersoutlook.

The 2018 JPMorgan Chase Business Leaders Outlook survey was conducted online in January 2018 with 1,685 executives of midsize companies (annual revenue of $20 million to $500 million) and 955 small business leaders ($100,000 to $20 million) in the United States. The results are within statistical parameters for validity, and the error rate is +/- 2.5% at a 95% confidence interval.