Business Banking

Businesses Bullish on America

Business optimism for U.S. economy charges ahead, says 2017 JPMorgan Chase Business Leaders Outlook report

NEW YORK, NY Feb 21, 2017 Executives from midsize and small businesses feel dramatically better about the U.S. economy than a year ago, according to the 2017 JPMorgan Chase & Co. Business Leaders Outlook report released today.

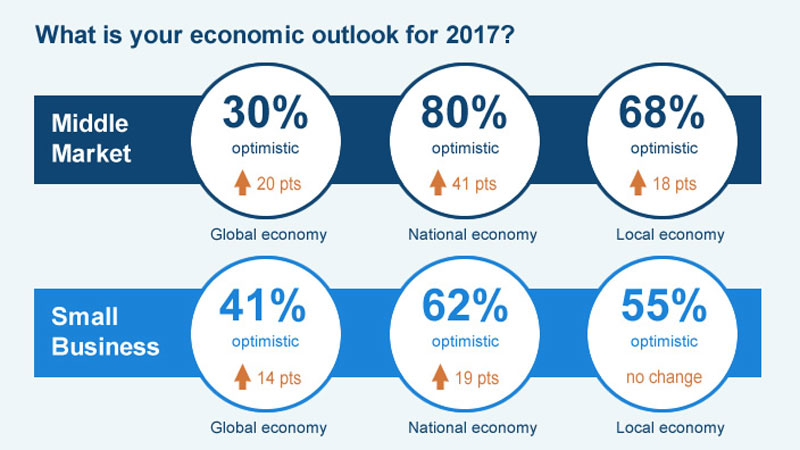

Middle market executives are twice as optimistic – 80%, up from 39% – about the U.S. economy than they were last year. Also, 62% of small business owners are bullish about the U.S. economy, up from 43%. Both groups feel even better about their own company’s prospects.

"U.S. companies are gaining confidence, and they anticipate new economic support from Washington in the coming year. Even some of their top business challenges – managing labor costs and trying to tap a limited supply of talent – are more growing pains than survival tactics."

Jim Glassman, senior economist at JPMorgan Chase

In fact, 76% of middle market executives and 61% of small businesses expect that the new administration will have a positive impact on their business. They want the government to focus first on:

- Reducing regulations (middle market at 67%, small business at 40%); and

- Lowering taxes (56%, 57%).

Middle Market Businesses

Executives expressed the most optimism in the survey’s seven years:

- Their company: 84%, up 14 points from 2016

- Local economy: 68%, up 18 points

- Global economy: 30%, up 20 points

They see their top business challenges as:

- Revenue/sales growth: 71%, down 3 from 2016

- Managing labor costs: 46%, up 6 points

- Limited supply of talent: 44%, up 4 points

The regulations they are most concerned about are:

- Healthcare: 63%, down 5 points from 2016

- Labor: 44%, up 5 points

- Fiscal policy: 42%, down 6 points

Small Businesses

Small business executives are optimistic for the year ahead:

- Their company: 71%, flat from 2016

- Local economy: 55%, flat

- Global economy: 41%, up 14 points

They see their top business challenges as:

- Growing revenue/sales: 38%, down 10 points from 2016

- Uncertainty of economic conditions: 34%, flat

- Taxes: 28%, flat

The regulations they are most concerned about are similar to last year’s:

- Taxes: 46%, flat from 2016

- Healthcare regulation: 44%, up 3 points

- Payroll/employment taxes: 42%, flat

For more information on the 2017 Business Leaders Outlook survey results, visit www.jpmorganchase.com/businessleadersoutlook.

[INFOGRAPHIC] 2017 Business Leaders Outlook: Midsize

Methodology

The 2017 JPMorgan Chase Business Leaders Outlook survey sets out to understand businesses perceptions of both domestic and international economic and regulatory conditions, as well as to understand the concerns facing these organizations. The online survey was conducted from January 3 to January 20, 2017. More than 1,400 middle market executives (annual revenue between $20 million and $500 million); and a total of 950 small businesses (annual revenue between $100,000 and $20 million) in the United States participated in the survey. The results are within statistical parameters for validity, and the error rate is +/- 2.5% for the middle market survey and +/-3% for the small business survey, both at the 95% confidence interval.