Consumer Banking

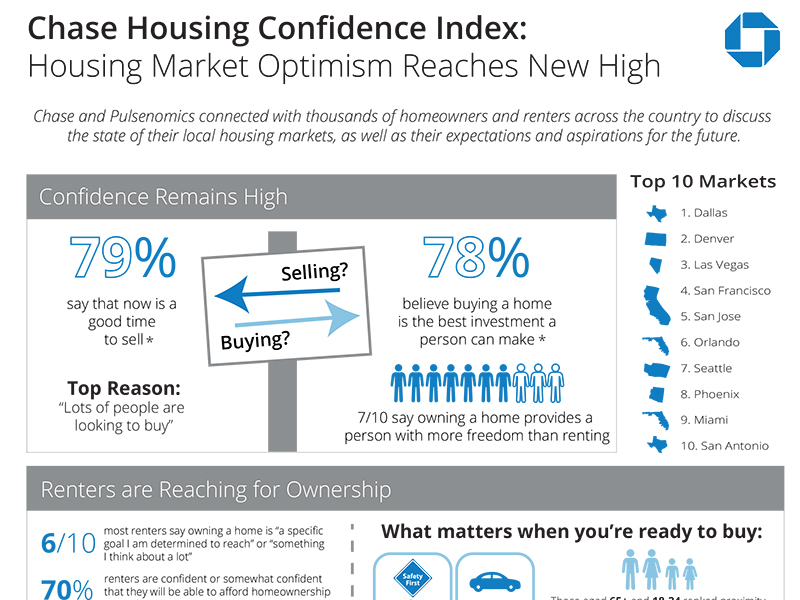

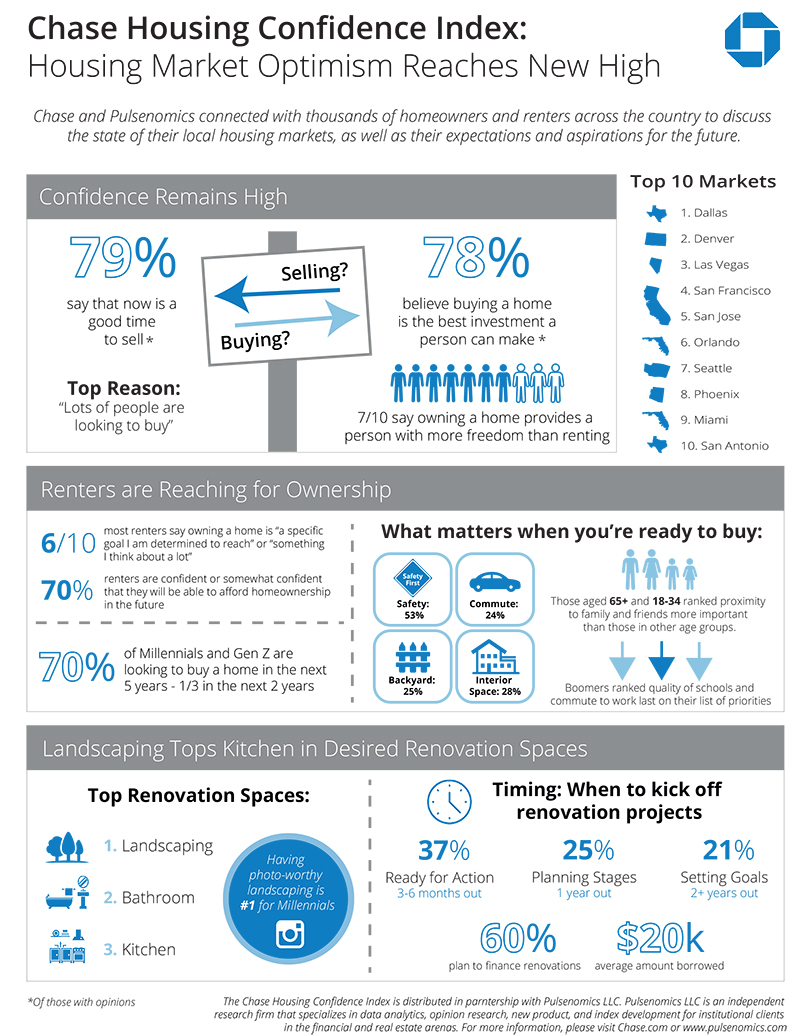

Confidence in Housing Market Reaches Highest Levels since 2014, Dallas Tops the List

Chase Launches Housing Confidence Index for National Homeownership Month

NEW YORK, NY Jun 27, 2018 Today, Chase introduces a new housing confidence index in partnership with Pulsenomics showing record highs among U.S. homeowners and renters in three key measurement areas: their take on market conditions, aspirations for homeownership, and expectations regarding home values and affordability.

The Chase Housing Confidence Index™ (HCI) systematically measures and tracks key dimensions of consumer confidence in housing markets across the United States using data collected in the U.S. Housing Confidence Survey™ (HCS). Each edition of the newly-expanded HCI entails compilation of response data from more than 15,500 household surveys completed by homeowners and renters across the country. The index uses a 0–100 scale; levels above 50 are positive readings.

“These record results were driven by healthy assessments of local real estate market conditions among existing homeowners, but even more so by surging expectations among renters," said Terry Loebs, founder of Pulsenomics. “Seven in ten renters now express confidence in their ability to afford a home someday, and nearly three-quarters of those with an opinion say that buying a home is the best long-term investment a person can make.”

Western region households are leading the country’s housing market optimism. Dallas, Denver and Las Vegas, the three cities with the highest housing confidence levels, have all seen more than 8-point index increases since the 2014 inception of HCI.

Dallas also topped the list for strongest homeownership aspirations. Eighty percent of Dallas renters are confident they will own a home someday, while 70 percent plan to purchase in the next five years. Dallas has also seen a growing job market over the last few years with large corporations moving to the area, which may have added to this positive outlook on homebuying. More than 60 percent of Dallas homeowners said it is a good time to sell a home, with the majority citing the abundance of home shoppers as the most important reason.

Homeowners and Renters Agree it’s a Good Time to Buy and Sell

When asked if it was a good time to buy and sell a home, both homeowners and renters across the country agree that now is a good time for people to purchase. By a ratio of nearly three-to-one, the number of households who believe ‘now is a good time to buy a home’ exceeds the number who said now is a bad time. That ratio was even higher in the South and the Midwest regions of the country, where more than one-half of respondents said it was a good time to buy. Only 17 percent said it was a bad time to buy, with most citing affordability as their main concern.

“Affordability remains a top focus for buyers in the market today, but we are encouraged by the overwhelmingly positive outlook across the country,” said Amy Bonitatibus, Chief Marketing Officer for Chase Home Lending. “We have found innovative ways to address some of the affordability concerns by tackling the main barriers to homeownership with education grants, as well as down payment, closing cost assistance and low down payment products. Our Home Lending advisors are helping customers create customized plans for reaching homebuying goals.”

Renters

Nearly 60 percent of renters across the country are looking to buy in the next five years. Seventy percent of those renters are Millennials. The highest responses came from the South, where 62 percent are expecting to buy in the next five years and 33 percent looking to purchase in the next two years.

Fifty-three percent of renters said, when it comes time to buy a home, the most important feature will be neighborhood safety. Renters said the size of the home and the size of the backyard were the next top choices with 28 and 25 percent, respectively. Choosing between an urban or suburban setting was much lower on the list of priorities with 9 and 15 percent, respectively.

For Millennials, a short commute to work was ranked much more important than a suburban setting versus urban setting, with 31 percent saying commuting time was more important than location. Only 10 percent of Millennials said an urban setting was the most important feature in their home, while 11 percent said a suburban location mattered most.

Landscaping Becomes a Top Renovation Priority

Homeowners are beginning to see their outdoor spaces as a prime makeover target, beating out kitchens and tying with bathrooms at the top of their renovation wish list.

Top Renovation Spaces

- Landscaping

- Bathroom

- Kitchen

“Everyone wants that Instagram-worthy curb-appeal,” said Bonitatibus. “Millennial homeowners ranked ‘new landscaping’ as their top choice for renovation. It is also an area of the home that can be more affordable to tackle immediately, and over 40 percent of these younger owners are looking to install new landscaping in the next few years.”

Of the survey respondents who said they were looking to renovate a space in their home, 60 percent plan to take out financing to complete their plans. More than a third say they are ready to take action in the next 3-6 months and another 25 percent are about a year out from kicking off. On average, they plan to spend about $20,000 to get the job done.

The Chase Housing Confidence Index (HCI) and U.S. Housing Confidence Survey™ (HCS) are produced by Pulsenomics LLC, an independent index, real estate intelligence and opinion research firm. This edition of HCI was derived from household survey data collected in spring 2018. To learn more about HCI and HCS, please visit www.chase.com or www.pulsenomics.com.