Consumer Banking

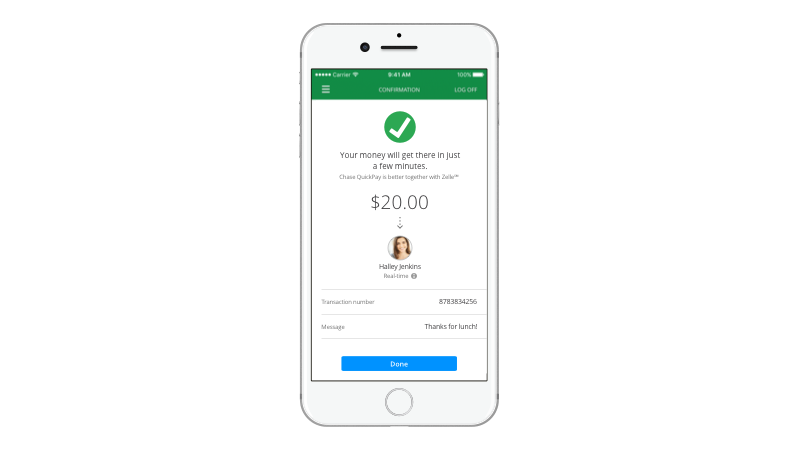

Chase Launches QuickPay with Zelle

Jun 14, 2017 Customers can receive and send money to more people in real time.

Chase customers now have broader access to an easy, safe and fast way to pay other individuals through the ZelleSM network. When Chase customers use Chase’s person-to-person payments functionality, they’ll automatically see Chase QuickPay® with Zelle in the Chase Mobile® app and on chase.com. In the next few weeks, customers will be able to send and receive money in minutes with about 86 million customers of more than a dozen financial institutions without leaving the security of their bank app.

“A growing number of customers are choosing Chase because they like our online and mobile capabilities,” said Bill Wallace, Head of Chase Digital Banking. “Consumers want a safe and fast way to make payments and Chase QuickPay with Zelle offers them the ability to pay each other in a simple and consistent way.”

Chase customers sent more than $28 billion person-to-person transactions through Chase QuickPay in 2016, representing 38% growth over 2015. QuickPay with Zelle allows payments to be sent and received with each other by simply using the recipient’s mobile phone number or email address. Funds sent via Chase QuickPay with Zelle are typically available within minutes.

“By connecting with an additional dozen plus financial institutions, we expect more people will want to pay the dog walker or share the dinner bill seamlessly using QuickPay with Zelle,” added Wallace.

Chase QuickPay with Zelle customers will continue to have the ability to:

- Send same day or schedule future dated payments

- Request money and directly respond to payment requests

- Easily manage and track payments and requests

- Add recipients directly from their phone contacts list

For more information visit chase.com