Lending

Most Homeowners Want to Upgrade Their Current Home, New Chase Survey Finds

Homeowners Willing To Put In The Sweat Equity To Make It Happen

NEW YORK Oct 03, 2019 Most U.S. homeowners expect to make improvements to their property in the next year to build their home’s value, according to a Chase Home Lending survey released today. Chase teamed up with Drew and Jonathan Scott -- TV personalities, entrepreneurs and authors -- to discuss why homeowners wanted to improve, how much they planned to do themselves and how much they expected to pay for it.

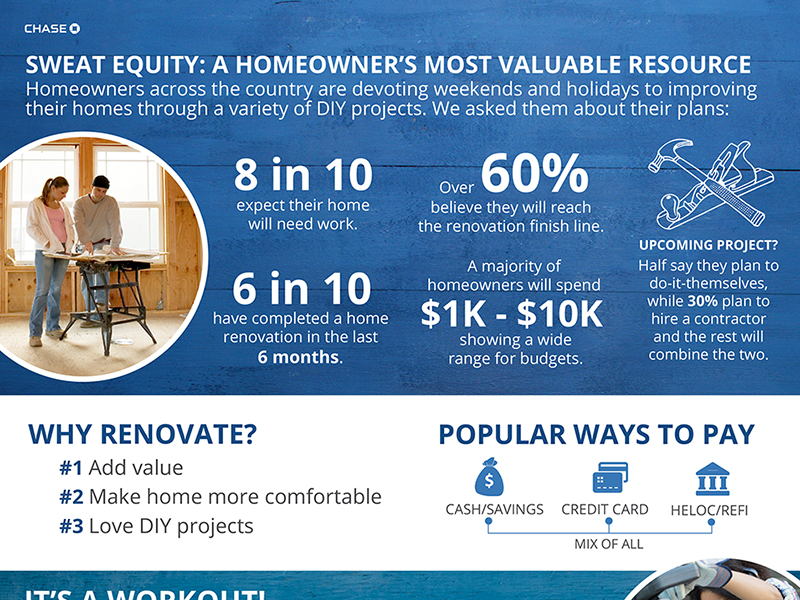

Eight in 10 respondents anticipate taking on a home-improvement project. In fact, 60 percent completed a project in the last six months, according to the survey “Sweat Equity: A Homeowner’s Most Valuable Resource.” More than 70 percent of respondents plan to do at least some of the work themselves, though some may tap into professionals when necessary.

“More and more homeowners are taking matters into their own hands by doing the work themselves,” said Amy Bonitatibus, Chief Marketing and Communications Officer for Chase Home Lending. “While cash is still king, we are seeing an increase in the number of people who are taking advantage of the recent drop in rates and paying for their renovations by tapping into the equity in their home.”

“Elevating your property from a house to a home can be within reach,” said Drew Scott. “Whether it’s sprucing up your outdoor deck, or updating your kitchen with a trendy tile backsplash, selecting the right projects can create long-term value and make your property more attractive for future buyers.”

Added Jonathan Scott: “Our partnership with Chase brings creativity and expertise to help turn sweat equity into home equity.”

From Inspiration Board to Reality

When looking at homeowners’ motivations for upgrading their home, the survey found that the top three reasons were to:

- Add value

- Create a comfortable space for family and for hosting

- Feed their hobby of DIY/home improvement

Paying for Home Improvements

Chase also looked at how much homeowners were setting aside for renovations. The survey found that:

- 58 percent projected spending up to $10,000 on a project

- 21 percent foresee projects of $10,000 to $25,000

- 21 percent aimed high, at least $25,000

While some plan to use cash and savings for their home projects, many others are looking at a mix of savings, credit cards and leveraging their property value through a home equity line of credit or cash-out refinance. A home equity line of credit allows homeowners to tap into the value of their home to access cash as needed at an attractive interest rate.

A total of 1,000 U.S.-based homeowners ages 18 to 65 were surveyed in September 2019.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.7 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: Nearly 5,000 branches in 28 states and the District of Columbia, 16,000 ATMs, mobile, online and by phone. For more information, go to chase.com.