Consumer Banking

New Chase account helps kids develop healthy saving and spending habits

NEW YORK Oct 12, 2020 Chase First Banking is designed to put parents in control, but gives kids freedom to learn how to earn, spend and save; powered by Greenlight®, a fintech for families

Parents and kids now have a way to help them manage allowances, complete and check off chores, monitor spending, and save towards a goal. Launching today, Chase First Banking is a new checking account with no monthly fees designed to help parents teach kids and teens about the importance of money management through the Chase Mobile app.

The account was built by Chase in collaboration with Greenlight—a company on a mission to help parents raise financially smart kids.

Most kids learn about money when out shopping with their families. But as more transactions happen digitally, kids can lose touch with real-time discussions on the value of money and how to think about purchases.

“Families are juggling so many more responsibilities today than ever before,” said Allison Beer, Head of Digital for Consumer & Community Banking at JPMorgan Chase. “To help, we’ve made it easy for parents to manage kids’ allowances, keep track of chores and teach important financial skills from within the Chase Mobile app.”

To keep things simple, Chase First Banking accounts have three features—Earn, Spend and Save. Here is how it works:

For adults:

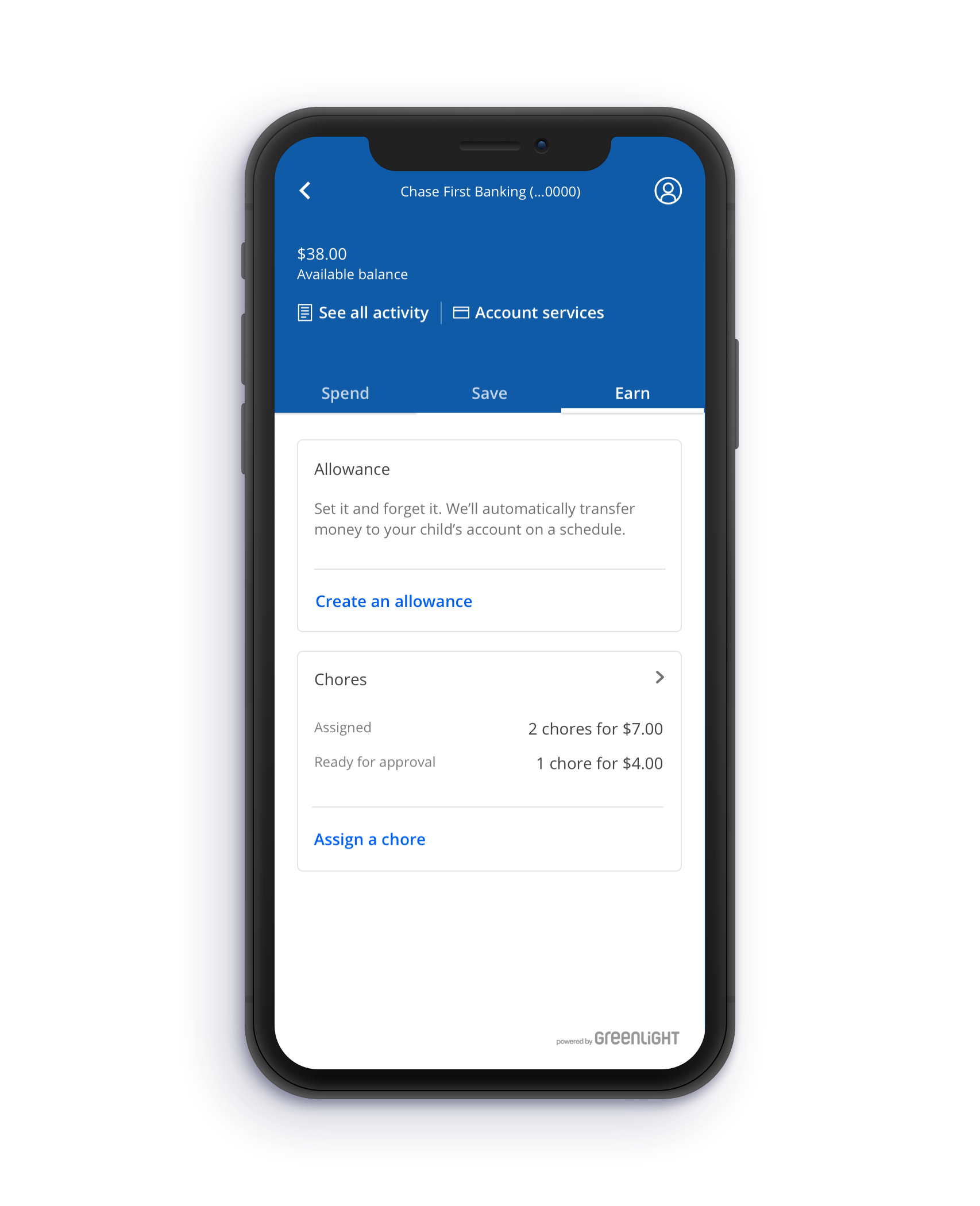

- As the owner of the account, the Earn tab allows them to set allowances and assign chores, including how much kids will receive and when they need to be completed.

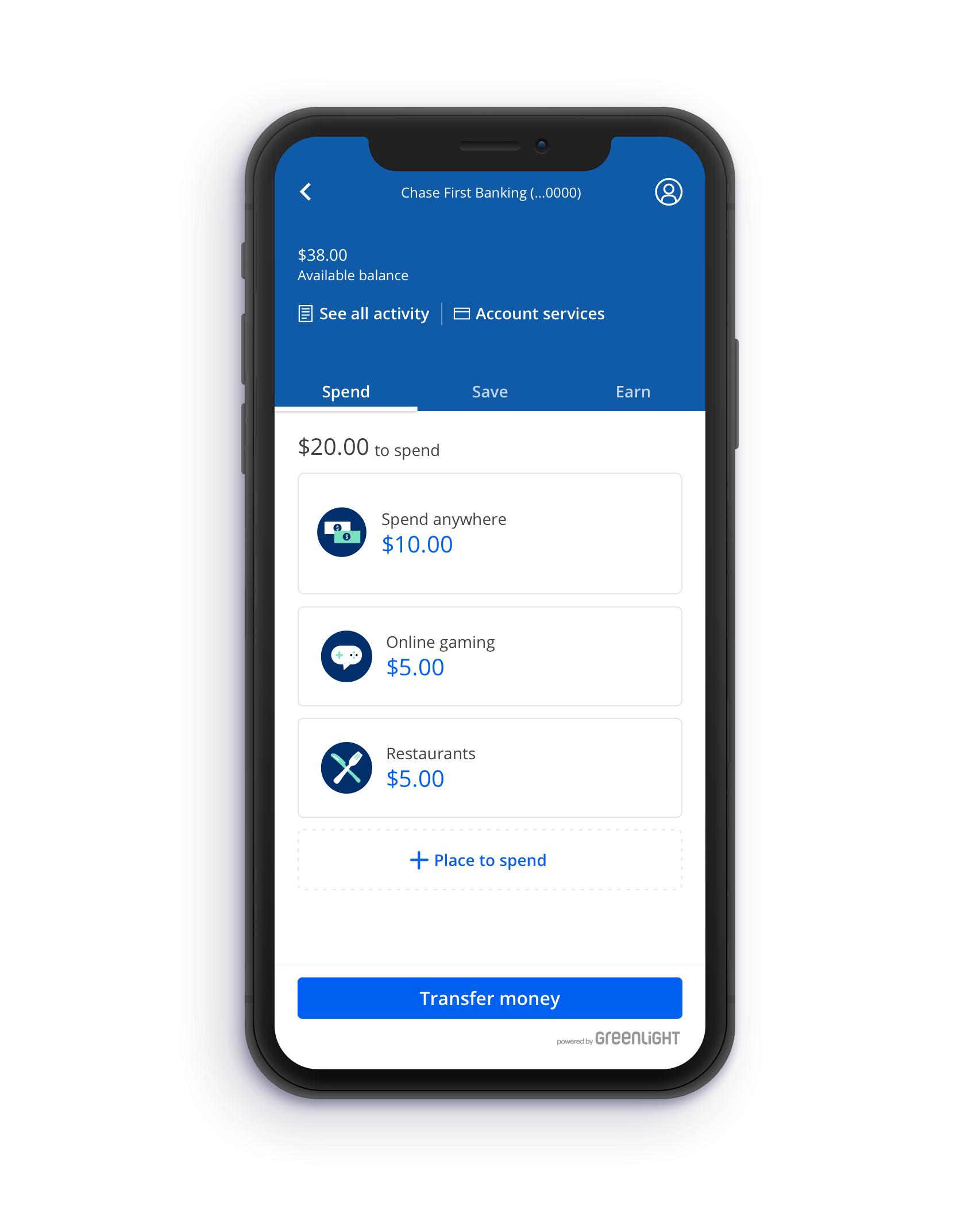

- They can set the amount kids can spend and at what types of stores from the Spend tab and receive alerts when spending happens.

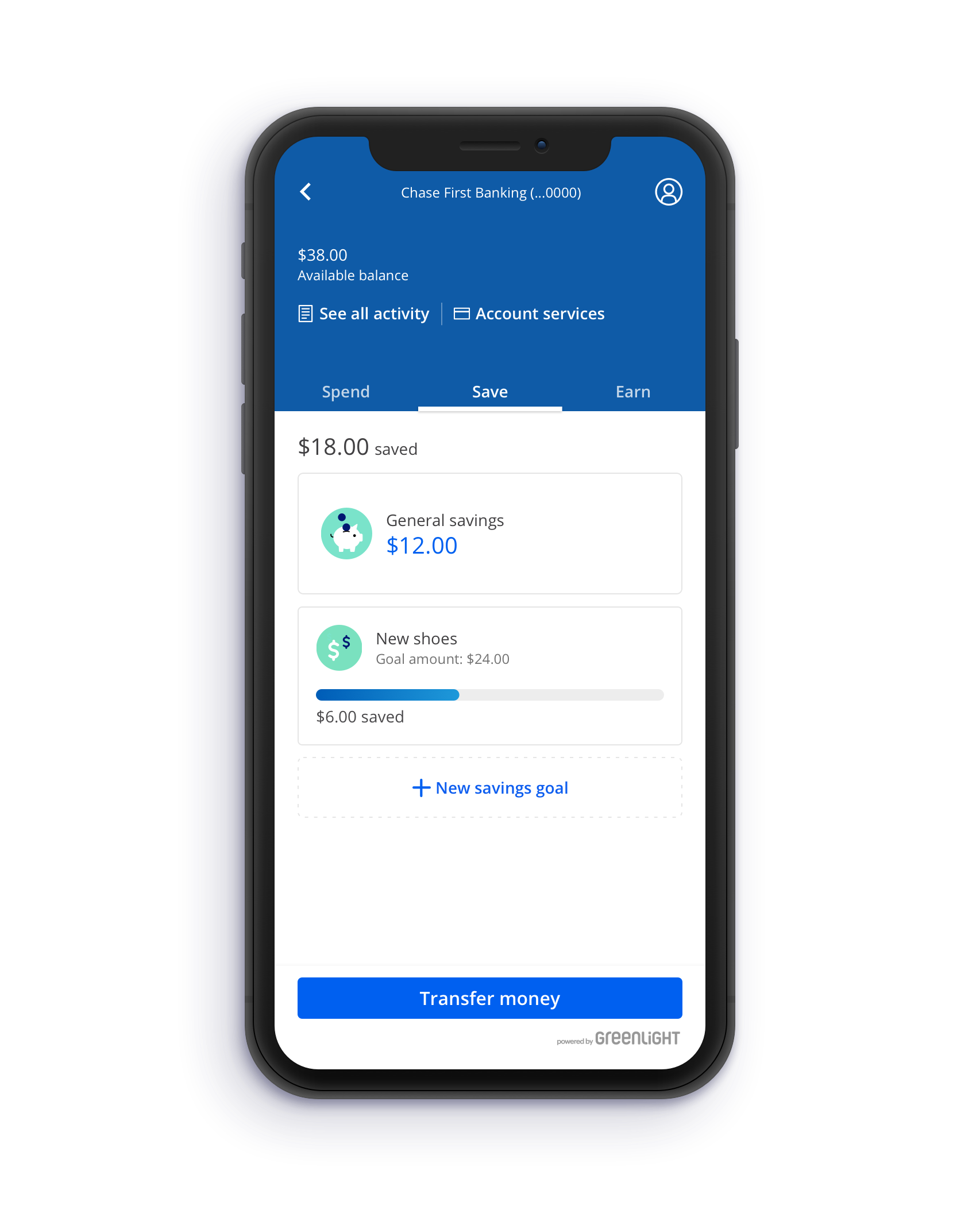

- They also have exclusive control over moving funds from Save once kids complete a goal.

- For extra peace of mind, they also can turn features on and off, lock their kid’s debit card, and cancel and adjust chores or allowances.

For kids:

- Each child gets their own personal debit card that can be used only based on the spending limits set by their parents.

- From their own Chase Mobile app, Earn lets them see what chores they have been assigned, check them off when completed, and see when their allowance is paid.

- Spend helps them know how much they have and where they can make purchases.

- Save helps them work toward a financial goal and alerts their parents when it’s been achieved.

- They can also lock or freeze their card if they misplace it.

“Having this account is like having a financial health learner’s permit: kids can learn how to manage money, and parents have the ability to guide their experience safely and in real-time,” said Kavita Kamdar, Head of Chase First Banking, JPMorgan Chase.

Exclusively for Chase retail deposit account customers, Chase First Banking accounts can be opened for free by parents, adult family members and legal guardians through their Chase Mobile app. Chase has over 54 million digitally active and 39 million mobile active customers. To learn more, including videos on how it works, visit Chase.com/FirstBanking starting today, or visit a Chase branch. In addition to Chase First Banking, the bank also offers checking and savings accounts for high school and college-aged youth.

###

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $3.1 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: More than 4,900 branches in 38 states and the District of Columbia, 16,000 ATMs, mobile, online and by phone. For more information, go to chase.com.

For more information, contact:

Maribel Ferrer, Maribel.Ferrer@chase.com

Paul Lussier, Paul.Lussier@chase.com