Lending

New Chase Study Finds That the Majority of First-time Millennial Homebuyers Feel Financially Ready, Excited to Purchase a Home

More Than 70 Percent of Millennials Are Inclined to Cut Back on Weekend Activities So They Can Purchase a Home in the Next 12 Months

New York, NY May 29, 2019 Today, Chase Home Lending released a new study, “Readying to Buy: First-Time Homebuyers Share Motivation & Willingness to Purchase,” revealing the attitudes, preferences, tendencies and behaviors that this demographic has toward the homebuying journey. The study looked to better understand Millennials’ urgency to buy a home, lifestyle adjustments they’re willing to make to prepare for that big purchase, and their general perception of homebuying.

Millennials held the highest share of homebuying activity in 2018 out of all other generations for the fifth consecutive year, according to the National Association of Realtors. This group of prospective homebuyers boasts a strong desire for ownership and remains committed to achieving their home-purchasing goals. The data from Chase’s “Readying to Buy” study further supports this attitude, as the majority of those surveyed expressed willingness to make tactical and intentional lifestyle changes, or swaps, if it would set them up for success on their homebuying journey in the very near future.

“Millennials are hyper-focused on their personal path to homeownership. Both mature and modern, they understand that this is a momentous decision, and are completely committed to making it a reality,” said Amy Bonitatibus, Chief Marketing and Communications Officer for Chase Home Lending. “And despite common misconceptions, they’re planning ahead, making smart financial decisions and willing to adjust their current lifestyle to make homeownership possible.”

Millennials Are Willing to Slow Down Casual Spending to Save for a Home

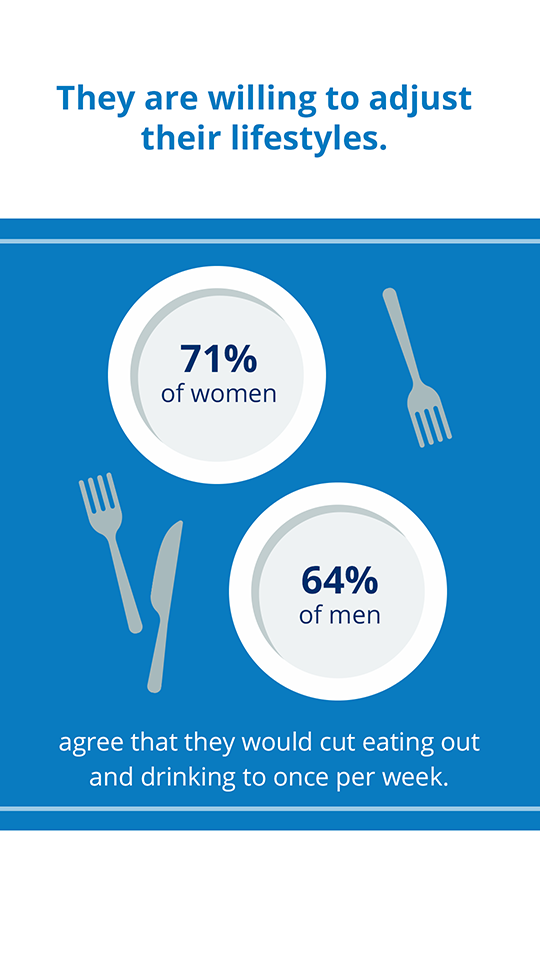

- Seventy percent of millennial first-time homebuyers surveyed are willing to cut back on weekend activities such as shopping, going to the movies and splurging at the spa to once per month if it meant they could purchase a home in the next 12 months. The data also revealed that women, specifically, are incredibly determined and empowered to adjust their lifestyles in order to pave a more positive, achievable path to homeownership—71 percent of female respondents surveyed noted they’re willing to limit eating and drinking out to once per week if it set them up for homebuying success in the next 12 months.

Let’s Talk About It—Millennials Are Open to Discussing Homeownership with Peers in Order to Understand What They Need, Want & Where They Stand

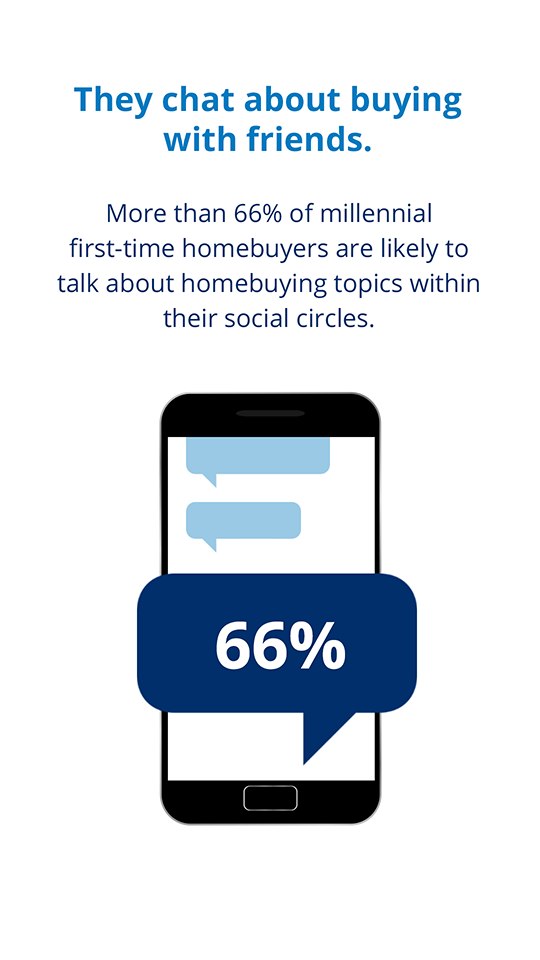

- According to the study, more than two-thirds of millennial first-time homebuyers surveyed (68 percent) expressed interest in talking about homebuying topics (affordability, homebuying journey, neighborhood options) with friends and varying social circles. This shows that they value the opinions and knowledge of their peers, and are open to going beyond traditional resources (e.g., parents) to learn more. Further, 71 percent of women respondents are willing to discuss homebuying topics with friends, and more than 50 percent of surveyed men are likely to engage with, or post about, homebuying topics on social media.

Don’t Be a Debbie Downer—Millennials Are Focused, Motivated & Have a Strong Desire for Homeownership

- Contrary to national sentiment or assumption, the Chase study found that the majority of millennial first-time homebuyers surveyed (52 percent) feel financially ready to buy a home. Even while juggling various financial priorities or obligations—including paying off student loans and improving credit scores—the vast majority (93 percent) know that homeownership is on the horizon and feel either excited or hopeful about the homebuying process. Additionally, the desire to own their own space, familial changes (e.g., marriage or having a child) and investments/wealth building were ranked as the top three motivators to buy.

- Millennial respondents also express determination and confidence when asked about their perceptions of a home search. Nearly half of those surveyed said they feel confident about their knowledge of the home-financing process as well as the upkeep and maintenance that comes with a residence.

The report is based on the responses of 1,000 U.S.- based millennials ages 22 to 38.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.7 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: Nearly 5,000 branches, 16,000 ATMs, mobile, online and by phone. For more information, go to Chase.com.