Consumer Banking

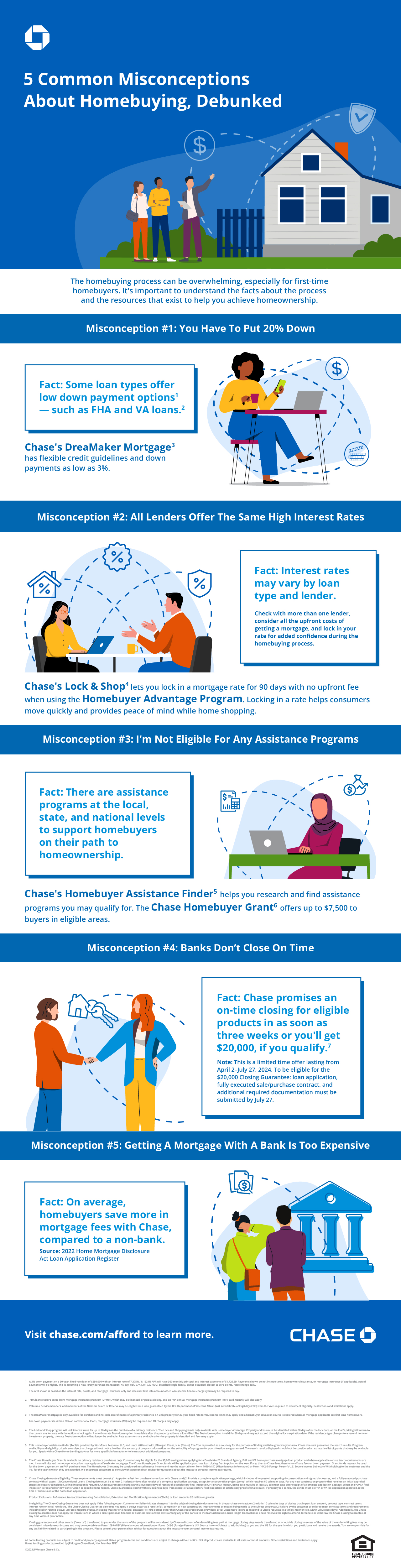

5 Common Misconceptions About Homebuying, Debunked

The homebuying process can be overwhelming, especially for first-time homebuyers. It’s important to understand the real facts about the process and resources that exist to help you achieve homeownership.

The homebuying process can be overwhelming, especially for first-time homebuyers. It’s important to understand the real facts about the process and resources that exist to help you achieve homeownership.

Misconception #1: You Have To Put 20% Down

- Fact: Some loan types offer low down payment options1 – such as FHA and VA loans2.

- Chase’s DreaMaker Mortgage3 has flexible credit guidelines and down payments as low as 3%.

Misconception #2: All Lenders Offer The Same High Interest Rates

- Fact: Interest rates may vary by loan type and lender.

- Check with more than one lender, consider all the upfront costs of getting a mortgage, and lock in your rate for added confidence during the homebuying process.

- Chase’s Lock & Shop4 lets you lock in a mortgage rate for 90 days with no upfront fee when using the Homebuyer Advantage Program. Locking in a rate helps consumers move quickly and provides peace of mind while home shopping.

Misconception #3: I’m Not Eligible For Any Assistance Programs

- Fact: There are assistance programs at the local, state and national levels to support homebuyers on their path to homeownership.

- Chase’s Homebuyer Assistance Finder5 helps you research and find assistance programs you may qualify for. The Chase Homebuyer Grant6 offers up to $7,500 to buyers in eligible areas.

Misconception #4: Banks Don’t Close On Time

- Fact: Chase promises an on-time closing for eligible products in as soon as three weeks or you’ll get $20,000, if you qualify.7

- Note: This is a limited time offer lasting from April 2-July 27, 2024. To be eligible for the $20,000 Closing Guarantee: loan application, fully executed sales/purchase contract, and additional required documentation must be submitted by July 27.

Misconception #5: Getting A Mortgage With A Bank Is Too Expensive

- Fact: On average, homebuyers save more in mortgage fees with Chase compared to a non-bank.

- Source: 2022 Home Mortgage Disclosure Act Loan Application Register

Visit Chase.com/afford to learn more.

Disclosures

- A 3% down payment on a 30-year, fixed-rate loan of $250,000 with an interest rate of 7.375% / 8.1624% APR will have 360 monthly principal and interest payments of $1,726.69. Payments shown do not include taxes, homeowners insurance, or mortgage insurance (if applicable). Actual payments will be higher. This is assuming a New Jersey purchase transaction, 45-day lock, 97% LTV, 720 FICO, detached single family, owner-occupied, closest to zero points, rates change daily.

The APR shown is based on the interest rate, points, and mortgage insurance only and does not take into account other loan-specific finance charges you may be required to pay.

- FHA loans require an up-front mortgage insurance premium (UFMIP), which may be financed, or paid at closing, and an FHA annual mortgage insurance premium (MIP) paid monthly will also apply.

Veterans, Servicemembers, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs (VA). A Certificate of Eligibility (COE) from the VA is required to document eligibility. Restrictions and limitations apply.

- The DreaMaker mortgage is only available for purchase and no-cash-out refinance of a primary residence 1-4 unit property for 30-year fixed-rate terms. Income limits may apply and a homebuyer education course is required when all mortgage applicants are first time homebuyers.

For down payments less than 20% on conventional loans, mortgage insurance (MI) may be required and MI charges may apply.

- The Lock and Shop program will lock interest rates for up to 90 days on the purchase of a primary residence. The Lock and Shop program is only available with Homebuyer Advantage. Property address must be identified within 60 days after the lock date, or the loan’s pricing will return to the current market rate with the option to lock again. A one-time rate float-down option is available after the property address is identified. The float-down option is valid for 30 days and may not exceed the original lock expiration date. If the residence type changes to a second home or investment property, the rate float-down option will no longer be available. Rate extensions are available after the property is identified and fees may apply.

- This Homebuyer assistance finder (Tool) is provided by Workforce Resource, LLC, and is not affiliated with JPMorgan Chase, N.A. (Chase). The Tool is provided as a courtesy for the purpose of finding available grants in your area. Chase does not guarantee the search results. Program availability and eligibility criteria are subject to change without notice. Neither the accuracy of program information nor the suitability of a program for your situation are guaranteed. The search results displayed should not be considered an exhaustive list of grants that may be available for you. Speak with a Chase Home Lending Advisor for more specific information or to learn about additional programs.

- The Chase Homebuyer Grant is available on primary residence purchases only. Customer may be eligible for the $5,000 savings when applying for a DreaMaker℠, Standard Agency, FHA and VA home purchase mortgage loan product and where applicable census tract requirements are met. Income limits and homebuyer education may apply on a DreaMaker mortgage. The Chase Homebuyer Grant funds will be applied at purchase loan closing first to points on the loan, if any, then to Chase fees, then to non-Chase fees or down payment. Grant funds may not be used for the down payment on an FHA purchase loan. The Homebuyer Grant may be considered miscellaneous income and may be reportable on Form 1099-MISC (Miscellaneous Information) or Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding) to the customer and the IRS, for the year in which they are awarded. We encourage customers to consult with a personal tax advisor for questions about the impact to personal income tax returns.

- Chase Closing Guarantee Eligibility: These requirements must be met: (1) Apply for a first lien purchase home loan with Chase; and (2) Provide a complete application package, which includes all requested supporting documentation and signed disclosures, and a fully-executed purchase contract with all pages. (3) Conventional Loans: Closing date must be at least 21 calendar days after receipt of a complete application package, except for a cooperative project (co-op) which requires 60 calendar days. For any new construction property that receives an initial appraisal subject to repairs/completion, a final inspection is required. Chase guarantees closing within 3 business days of receipt of a satisfactory final inspection. (4) FHA/VA loans: Closing date must be at least 30 calendar days after receipt of a complete application package. When an FHA/VA final inspection is required for new construction or specific home repairs, Chase guarantees closing within 5 business days from receipt of a satisfactory final inspection or satisfactory proof of final repairs. If property is a condo, the condo must be FHA or VA (as applicable) approved at the time of submission of the home loan application.

Product Exclusions: Refinances, transactions involving Consolidation, Extension and Modification Agreements (CEMAs) or loan amounts $2 million or greater.

Ineligibility: The Chase Closing Guarantee does not apply if the following occur: Customer- or Seller-initiates changes (1) to the original closing date documented in the purchase contract; or (2) within 10 calendar days of closing that impact loan amount, product type, contract terms, interest rate or initial rate locks. The Chase Closing Guarantee also does not apply if delays occur as a result of (1) completion of new construction, improvements or repairs being made to the subject property; (2) Failure by the customer or seller to meet contract terms and requirements, including seller-related delays; (3) Force majeure events, including weather or a natural disaster; (4) Third parties other than Chase-required service providers; or (5) Customer’s failure to respond to Chase requests in a timely manner (e.g. within 2 business days). Additionally, the Chase Closing Guarantee does not apply for transactions in which a direct personal, financial or business relationship exists among any of the parties to the transaction (non-arm’s length transactions). Chase reserves the right to amend, terminate or withdraw the Chase Closing Guarantee at any time without prior notice.

Closing guarantees and other awards (“awards”) transferred to you under the terms of the program will be considered by Chase a discount of underwriting fees paid at mortgage closing. Any awards transferred at or outside closing in excess of the value of the underwriting fees may be considered miscellaneous income and may be reportable on Form 1099-MISC (Miscellaneous Information) or Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding) to you and the IRS for the year in which you participate and receive the awards. You are responsible for any tax liability related to participating in the program. Please consult your personal tax advisor for questions about the impact to your personal income tax returns.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply. Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC

Chase is an Equal Housing Opportunity Lender.

©2023 JPMorgan Chase & Co.

5 Common Misconceptions About Homebuying, Debunked