Business Banking

Midsize Business Leaders Outlook 2017

Midsize Business Leaders Outlook 2017

Expectations on the Rise

Our seventh annual Business Leaders Outlook survey provides a snapshot of the current business environment, the trends influencing that environment and the decision-making of the executives who operate in it. Find out what more than 1,400 middle market executives think about the economy and how they’re planning for the year ahead.

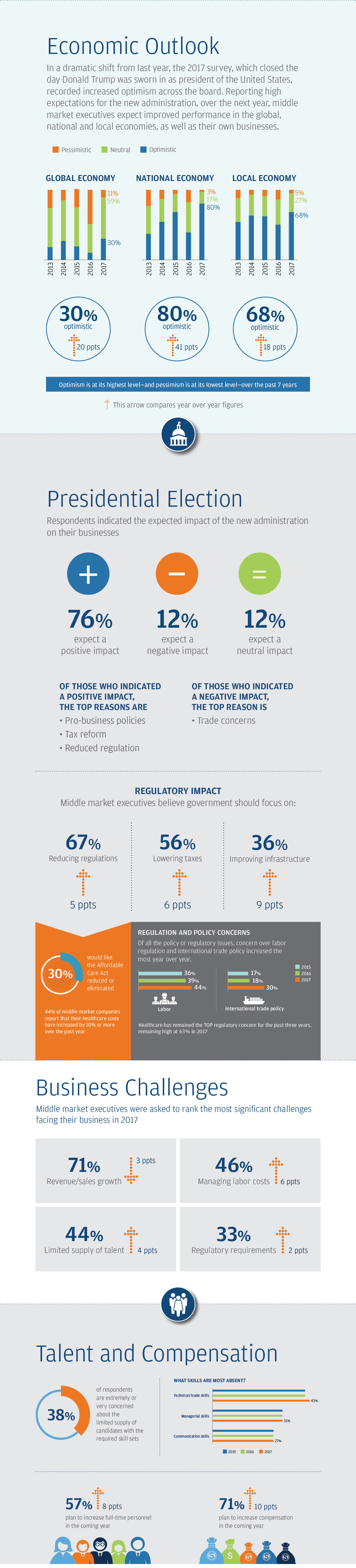

Economic Outlook

In a dramatic shift from last year, the 2017 survey, which closed the day Donald Trump was sworn in as president of the United States, recorded increased optimism across the board. Reporting high expectations for the new administration, over the next year, middle market executives expect improved performance in the global, national and local economies, as well as their own businesses.

Chart:

In 2017, 30% were optimistic about the global economy, 59% were neutral and 11% were pessimistic.

In 2017 80% were optimistic about the national economy, 17% were neutral and 3% were pessimistic.

In 2017, 68% were optimistic about the local economy, 27% were neutral and 5% were pessimistic.

Optimism is at its highest level—and pessimism is at its lowest level—over the past 7 years

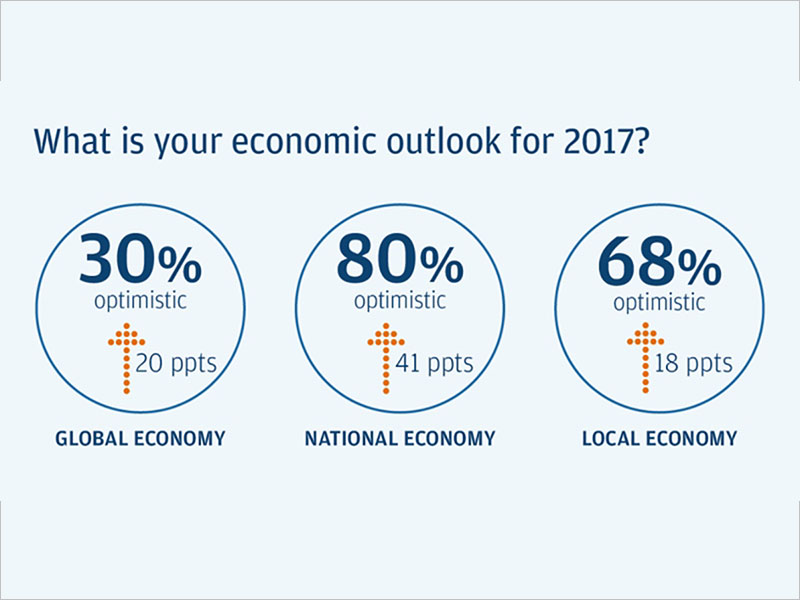

30% of respondents are optimistic about the Global Economy, up 20 percentage points year over year.

80% of respondents are optimistic about the National Economy, up 41 percentage points year over year.

68% of respondents are optimistic about the Local Economy, up 18 percentage points year over year.

Presidential Election

Respondents indicated the expected impact of the new administration on their businesses:

76% expect a positive impact

12% expect a negative impact

12% expect a neutral impact

Of those who indicated a positive impact, the top reasons are:

- Pro-business policies

- Tax reform

- Regulation reductions

Of those who indicated a negative impact, the top reason is:

- Trade concerns

Regulatory Impact

Middle market executives believe government should focus on:

67% Said reducing regulations, up 5 percentage points year over year

56% Said lowering taxes, up 6 percentage points year over year

36% Said improving infrastructure, up 9 percentage points year over year

30% would like the Affordable Care Act reduced or eliminated

44% of middle market companies report that their healthcare costs have increased by 10% or more over the past year

Regulation and Policy Concerns

Of all the policy or regulatory issues, concern over labor regulation and international trade policy increased the most year over year.

Labor was a top concern of 44% in 2017, 39% in 2016 and 36% in 2015.

International trade policy was a top concern for 30% in 2017, 18% in 2016 and 17% in 2015.

Healthcare has remained the top regulatory concern for the past three years, remaining high at 63% in 2017

Business Challenges

Middle market executives were asked to rank the most significant challenges facing their businesses in 2017:

71% Said revenue/sales growth, down 3 percentage points year over year

46% Said Managing labor costs, up 6 percentage points year over year

44% Said limited supply of talent, up 4 percentage points year over year

33% Said regulatory requirements, up 2 percentage points year over year

Talent and Compensation

38% of respondents are extremely or very concerned about the limited supply of candidates with the required skill sets

What skills are most absent?

43 percent said technical/trade skills in 2017, an increase from 2015 and 2016.

31 percent said managerial skills, holding steady from 2015 and 2016.

27% said communication skills, holding steady from 2015 and 2016.

57% of respondents plan to increase full-time personnel in the coming year, up 8 percentage points year over year

71% of respondents plan to increase compensation in the coming year, up 10 percentage points year over year

© 2017 JPMorgan Chase & Co. All rights reserved.

Midsize Business Leaders Outlook 2017