Business Banking

Small Business Leaders Outlook 2017

An Update on Small Business Leaders Outlook 2017

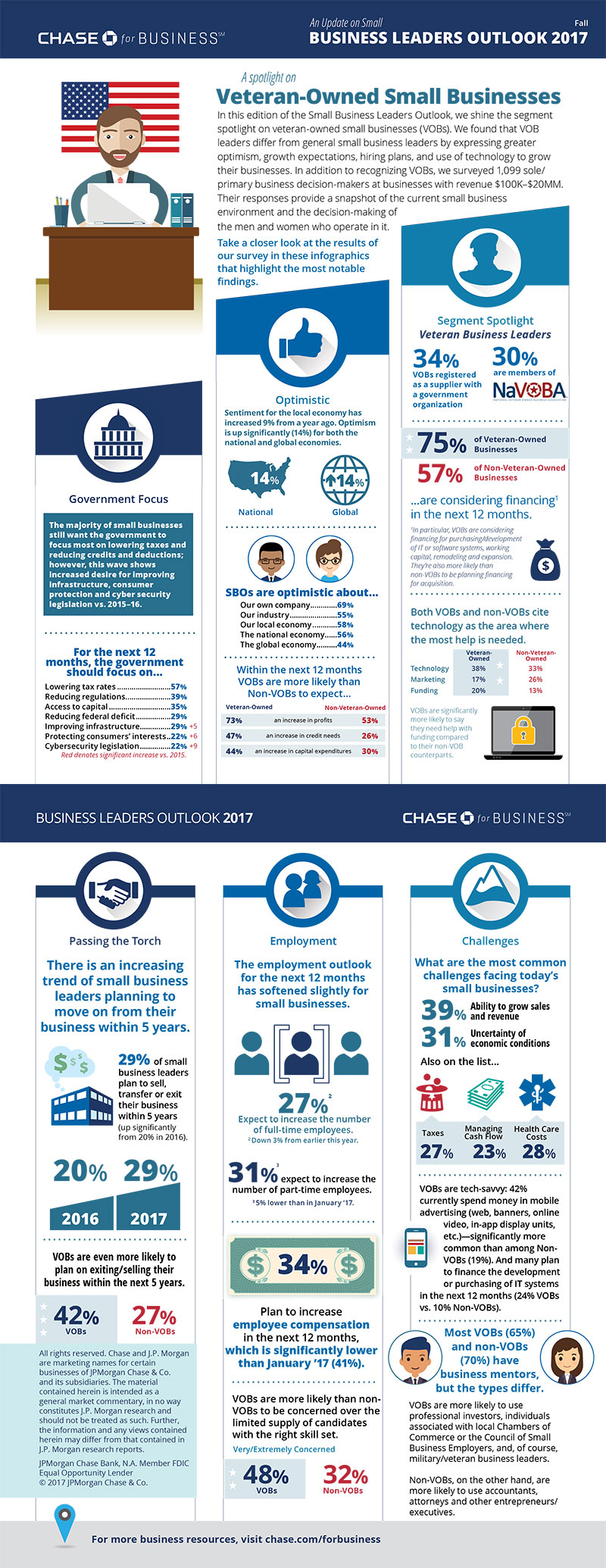

A spotlight on Veteran-Owned Small Businesses

In this edition of the Small Business Leaders Outlook, we shine the segment spotlight on veteran-owned small businesses (VOBs). We found that VOB leaders differ from general small business leaders by expressing greater optimism, growth expectations, hiring plans, and use of technology to grow their businesses. In addition to recognizing VOBs, we surveyed 1,099 sole/primary business decision-makers at businesses with revenue $100K–$20MM. Their responses provide a snapshot of the current small business environment and the decision-making of the men and women who operate in it.

Take a closer look at the results of our survey in these infographics that highlight the most notable findings.

Government Focus

The majority of small businesses still want the government to focus most on lowering taxes and reducing credits and deductions; however, this wave shows increased desire for improving infrastructure, consumer protection and cyber security legislation vs. 2015–16.

For the next 12 months, the government should focus on...

Lowering tax rates...........................57%

Reducing regulations.......................39%

Access to capital...............................35%

Reducing.federal.deficit..................29%

Improving infrastructure...............29% +5

Protecting consumers' interests...22% +6

Cybersecurity legislation................22% +9

Red denotes significant increase vs. 2015.

Optimistic

Sentiment for the local economy has increased 9% from a year ago. Optimism is up significantly (14%) for both the national and global economies.

SBOs are optimistic about...

Our own company..............69%

Our industry........................55%

Our local economy.............58%

The national economy.......56%

The global economy...........44%

Within the next 12 months VOBs are more likely than Non-VOBs to expect…

An increase in profits: Veteran-Owned: 73% | Non-Veteran-Owned: 53%

An increase in credit needs: Veteran-Owned: 47% | Non-Veteran-Owned: 26%

An increase in capital expenditures: Veteran-Owned: 44% | Non-Veteran-Owned: 30%

Segment Spotlight

Veteran Business Leaders

34% VOBs registered as a supplier with a government organization

30% are members of NaVOBA

75% of Veteran-Owned Businesses and 57% of Non-Veteran-Owned Businesses are considering financing1in the next 12 months.

1In particular, VOBs are considering financing for purchasing/development of IT or software systems, working capital, remodeling and expansion. They’re also more likely than non-VOBs to be planning financing for acquisition.

Both VOBs and non-VOBs cite technology as the area where the most help is needed.

Technology: Veteran-Owned: 38% | Non-Veteran-Owned: 33%

Marketing: Veteran-Owned: 17% | Non-Veteran-Owned: 26%

Funding: Veteran-Owned: 20% | Non-Veteran-Owned: 13%

VOBs are significantly more likely to say they need help with funding compared to their non-VOB counterparts.

Passing the Torch

There is an increasing trend of small business leaders planning to move on from their business within 5 years.

29% of small business leaders plan to sell, transfer or exit their business within 5 years (up significantly from 20% in 2016).

20% 2016 and 29% 2017

VOBs are even more likely to plan on exiting/selling their business within the next 5 years.

42% VOBs and 27% Non-VOBs

Employment

The employment outlook for the next 12 months has softened slightly for small businesses.

27%2 Expect to increase the number of full-time employees.

2 Down 3% from earlier this year.

31%3 expect to increase the number of part-time employees.

3 5% lower than in January ‘17.

34% Plan to increase employee compensation in the next 12 months, which is significantly lower than January ’17 (41%).

VOBs are more likely than non-VOBs to be concerned over the limited supply of candidates with the right skill set.

Very/Extremely Concerned: 48% VOBs and 32% Non-VOBs

Challenges

What are the most common challenges facing today’s small businesses?

39% Ability to grow sales and revenue

31% Uncertainty of economic conditions

Also on the list...Taxes 27%, Managing Cash Flow 23%, Health Care Costs 28%

VOBs are tech-savvy: 42% currently spend money in mobile advertising (web, banners, onlinevideo, in-app display units, etc.)—significantly more common than among Non- VOBs (19%). And many plan to finance the development or purchasing of IT systems in the next 12 months (24% VOBs vs. 10% Non-VOBs).

Most VOBs (65%) and non-VOBs (70%) have business mentors, but the types differ.

VOBs are more likely to use professional investors, individuals associated with local Chambers of Commerce or the Council of Small Business Employers, and, of course, military/veteran business leaders. Non-VOBs, on the other hand, are more likely to use accountants, attorneys and other entrepreneurs/executives.

Small Business Leaders Outlook 2017