Real Estate

Downsize or Right Size? Baby Boomers Looking to Renovations in Order to Age in Place

New Metros See Record Highs in Overall Confidence Index

New York, NY

| Jan 11, 2019New York, NY Jan 11, 2019 Today, Chase released the latest Housing Confidence Index TM, in partnership with Pulsenomics, with underlying data from The U.S. Housing Confidence Survey TM showing more than one-half of Baby Boomers plan to age in place, opting for home renovations to accommodate growing needs. [1] While the Millennials are making headlines as the largest home buying group today, Boomers are still flexing their economic muscles as an influential generation in the housing market, with 10,000 people reaching retirement age each day.

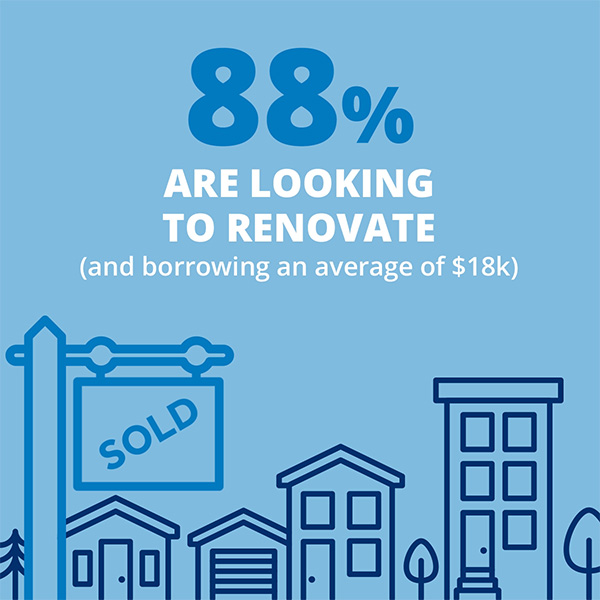

So how long do they plan to stay? Nearly nine in ten Boomer survey respondents are looking to make improvements to their current homes – suggesting that they’re in it for the long haul. The study also revealed that more than half of Boomer respondents don’t expect to purchase a different home in the future, and that a substantial majority of them plan to tackle a home improvement project in the next three years. Additionally, the survey confirmed that bathroom renovations are their top project. A safe and easy to navigate bathroom is vital to an aging homeowner, and many of these features – large walk-in showers and natural lighting – are today’s popular design trends.

“Nearly two-thirds of Baby Boomer respondents said home values are going up in their area,” said Amy Bonitatibus, Chief Marketing Officer for Chase Home Lending. “With home prices generally healthy across the country, two-thirds of these homeowners are turning to financing options like home equity lines of credit or cash-out refinances to complete their upgrades. On average, homeowners are financing about $18,000 per household with more than half saying they intend to start remodeling within a year.”

Renters’ Confidence in Housing Affordability Shifts, Putting New Metros at Record Highs

Renter confidence dipped after four years of steady results, as a nationwide sub-index of renters’ homeownership aspirations fell to a record low of 56.5.[2] Rising home values and an acute shortage of entry-level homes could have renters in some markets delaying their plans to buy.

To address affordability constraints in some communities, Chase announced an expansion of homebuyer grants in 2018, offering up to $3,000 in grants and incentives to low- and moderate-income homebuyers.

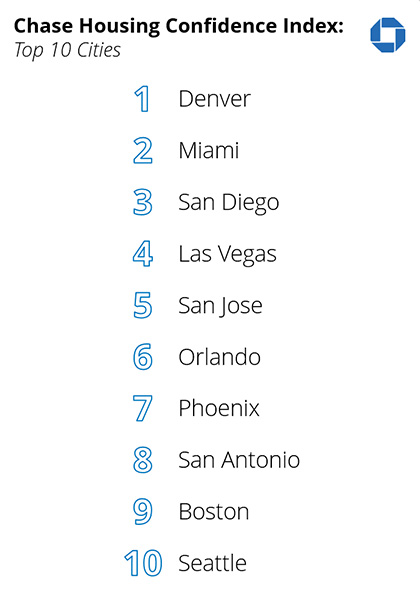

The Housing Confidence Index measures individual households’ assessments of local real estate market conditions, their homeownership aspirations, and their expectations regarding local home values and affordability. The largest jump in housing index measurements came from San Diego, Philadelphia, and Boston. Each of these markets boasted a large increase in the confidence index since spring of this year, knocking the first quarter leader, Dallas, out of the top 10 list altogether, after four years of consistent optimism.

“Our survey data confirm that renters are most concerned that their income and savings will prove insufficient to afford homeownership right now,” said Terry Loebs, founder of Pulsenomics. “However, renters’ long-term outlook remains quite optimistic--more than seven in ten renters with an opinion are confident, or somewhat confident, that they will be able to afford to own a home someday, and also say that buying a home is the best long-term investment a person can make.”

The Chase Housing Confidence Index (HCI) and U.S. Housing Confidence Survey™ (HCS) are produced by Pulsenomics LLC, an independent index, real estate intelligence and opinion research firm. This edition of HCI was derived from household survey data compiled in fall 2018. To learn more about HCI and HCS, please visit www.chase.com or www.pulsenomics.com.

[1] Of the 3,000 heads of household respondents in the nationwide survey frame, 753 are Baby Boomer homeowners, and 52 percent of them expect they will never move from their current home. Of the 12,500 households across 25 major metro areas that were individually surveyed (a total of 2,918 Baby Boomer households), 42 percent expect they will never move from their current home. At the individual metro area level, San Antonio Boomer owners registered the highest figure (62 percent), while Boston Boomers recorded the lowest (28 percent). All figures cited exclude indeterminate responses.

[2] Housing Confidence Indexes are on a 0-100 scale; readings below 50 indicate negative sentiment.

Chase Housing Confidence Index™ Methodology:

HCI is computed by Pulsenomics using a weighted diffusion index methodology. Diffusion indices measure the degree that data are diffused (dispersed) within a sample. Leading U.S. economic data series are commonly summarized or indexed using this approach. Presently, HCIs are calculated for each of 25 of the largest U.S. metropolitan statistical areas, selected combinations of those MSAs (Composite HCIs), for each of the four major U.S. geographic Regions, and for the nation as a whole (U.S. HCI). For each of the preceding geographic strata, Pulsenomics also produces HCI data series by tenure and generation categories (i.e., renters, homeowners, millennials).

U.S. Housing Confidence Survey™ Methodology:

HCS uses data collected electronically from large samples of internet users. To diversify the respondent pool and enhance representativeness, HCS samples are drawn from a large network of suppliers. The composition and quality of each sample and each sample provider are proactively monitored to ensure HCS data integrity and consistency. HCS uses stratified quota sampling, a method designed to capture key population characteristics that are proportional to those in the overall target population. This approach entails dividing a population into smaller groups, or strata, formed according to group members' shared attributes or characteristics. People less than 18 years of age, or adults aged 18 or over who are not the sole decision maker or a joint decision maker concerning household financial matters do not complete the survey. Eligible respondents complete the HCS questionnaire via the internet on their smart phone, tablet, desktop computer, or other electronic device. Key demographic information is collected from each respondent for post stratification weighting. For metropolitan area samples, balancing weights are calculated and applied at the individual metro area level so that HCS results reflect each market’s unique population and tenure attributes. Post stratification weights for each metro area are derived from United States Census data (American Community Survey 5 Year Estimates), and applied for key demographic characteristics (i.e., age, gender, race/ethnicity) and household tenure (i.e., owner occupied, renter occupied homes). For national samples, the balancing weights also include geographic region, and reflect the demographic characteristics and tenure profile of all U.S. households. HCS is administered in a uniform and systematic manner, and in accordance with applicable State laws, Federal laws, and codes of professional conduct (e.g., HCS embraces the codes of conduct of the American Association for Public Opinion Research, the National Council on Public Polls, and the Insights Association). Adherence to these codes ensure that HCS is deployed using the highest professional standards of survey administration, and enable Pulsenomics to produce housing confidence indexes that are authoritative and based on consistently reliable data.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.5 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: 5,100 branches, 16,000 ATMs, mobile, online and by phone.

About Pulsenomics

Pulsenomics LLC is an independent research firm that specializes in data analytics, opinion research, new product and index development for institutional clients in the financial and real estate arenas. Pulsenomics also designs and manages expert surveys and consumer polls to identify trends and expectations that are relevant to effective business management and monitoring economic health. Pulsenomics®, Housing Confidence Index™, and Housing Confidence Survey™ are trademarks of Pulsenomics LLC.