Millennials Bring Credit Home

@Chase Slate® Credit Outlook finds Millennials catching up, passing their elders in keeping tabs, improving credit scores in 2017

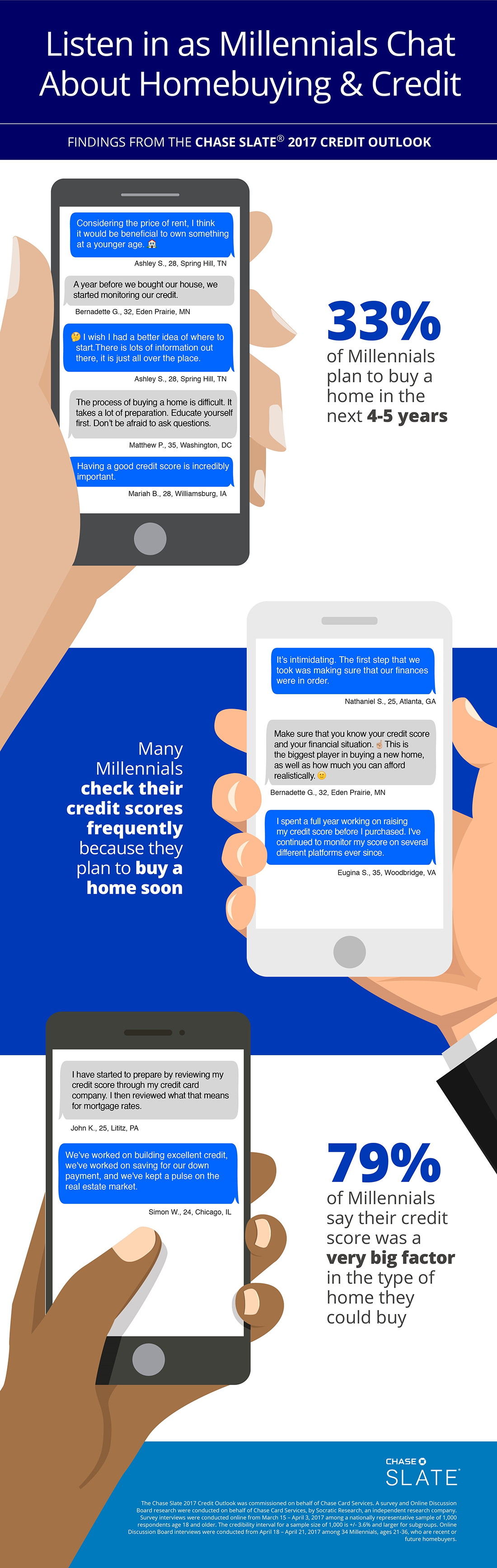

WILMINGTON, DE Jul 13, 2017 Millennials are taking their role as the next generation of homebuyers seriously, with one-third of them (33%) planning to purchase a home within the next four to five years, according to the Chase Slate 2017 Credit Outlook. That ambition has Millennials focusing on their credit scores and working to improve their credit health overall.

"Millennials are really doing their homework in preparation for buying a home in the near future. That includes monitoring their credit, which is key when purchasing a home."

Mical Jeanlys, General Manager of the Chase Slate credit card

Slate uncovered that Millennials:

- are checking their scores on the reg. Millennials (39%) check their credit scores every month; that’s more than Gen Xers (31%) and Boomers (28%).

- mean business. 62% of those who want to improve their credit have a plan of action.

- think home, sweet home. One-third of Millennials (33%) say they plan to buy a home in the next four to five years, while nearly one-quarter (24%) plan to purchase within the next three years.

Click on the image below to read what Millennials are saying about homebuying and credit.

“Americans – especially Millennials – are planning for their next major milestone,” says Farnoosh Torabi, a personal finance expert and Chase Slate Financial Education Ambassador. “They’re assessing where they stand today and working to improve their tomorrow, whether that means buying a car or home, co-signing on a lease, walking down the aisle or applying for a new job.”

About Chase Slate

With no annual fee, no penalty APR and tailored insights into your credit behavior, Chase Slate empowers cardmembers to manage their finances wisely now and in the future. Through the Chase Slate Credit Dashboard, cardmembers receive access to their FICO® Score, the top positive and negative factors impacting it and tips for improving their credit health overtime for free every month. The feature is available to cardmembers online at Chase.com

About the Chase Slate 2017 Credit Outlook Survey

The Chase Slate 2017 Credit Outlook was commissioned on behalf of Chase Card Services. A survey, Online Discussion Board and Video Diary Research were conducted on behalf of Chase Card Services, by Socratic Research, an independent research company. Survey interviews were conducted online from March 15 – April 3, 2017 among a nationally representative sample of 1,000 respondents age, 18 and older. The credibility interval for a sample size of 1,000 is +/- 3.6% and larger for subgroups.

Online Discussion Board interviews were conducted from April 18 – April 21, 2017 among 34 Millennials, ages 21-36, and the Video Diary Research interviews were conducted from April 26 – May 5, 2017 among 20 Millennials, ages 21-36. Both the Online Discussion Board and Video Diary Research were conducted nationally among Millennials who are recent or future homebuyers.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.5 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: 5,200 branches, 16,000 ATMs, mobile, online and by phone. For more information, go to Chase.com. For more information about Chase Slate, go to ChaseSlate.com. Also, Chase offers consumers the opportunity to monitor their credit score at no cost through Credit JourneySM