Business Banking

Business Leaders Outlook Spring/Summer 2016

BUSINESS LEADERS OUTLOOK SPRING/SUMMER 2016

Steady Optimism

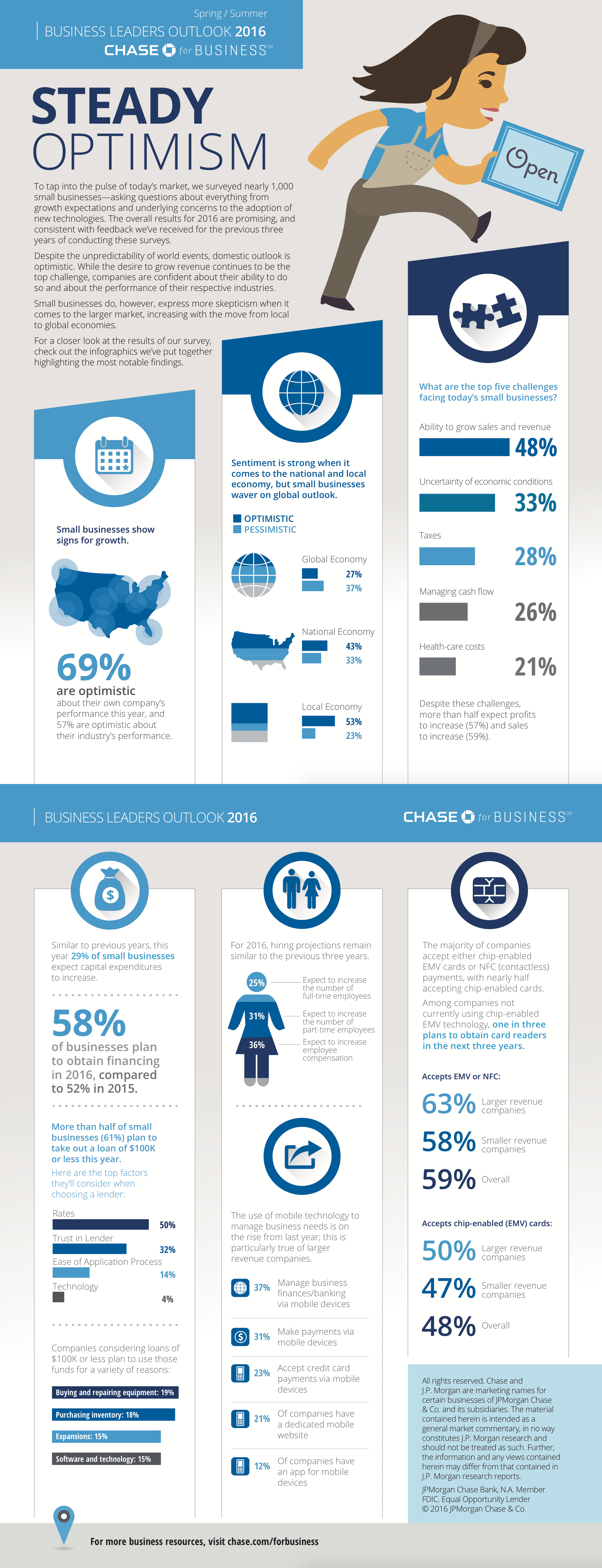

To tap into the pulse of today's market, we surveyed nearly1,000 small businesses--asking questions about everything from growth expectations and underlying concerns to the adoption of new technologies. The overall results for 2016 are promising, and consistent with feedback we've received for the previous three years of conducting these surveys.

Despite the unpredictability of world events, domestic outlook is optimistic. While the desire to grow revenue continues to be the top challenge, companies are confident about their ability to do so and about the performance of their respective industries.

Small businesses do, however, express more skepticism when it comes to the larger market, increasing with the move from local to global economies.

For a closer look at the result of our survey, check out the most notable findings:

Small businesses show signs for growth.

69% are optimistic about their company's performance this year

5% are optimistic about their industry's performance this year

Sentiment is strong when it comes to the national and local economy, but small businesses waver on global outlook.

Global Economy:

27% Optimistic

37% Pessimistic

National Economy:

43% Optimistic

33% Pessimistic

Local Economy:

53% Optimistic

23% Pessimistic

What are the top five challenges facing today's small businesses?

48% said the ability to grow sales and revenue

33% said uncertainty of economic conditions

28% said taxes

26% said managing cash flow

21% said health-care costs

Despite these challenges, more than half expect profits and sales to increase:

57% expect profits to increase

59% expect sales to increase

Similar to previous years, this year 29% of small businesses expect capital expenditures to increase.

58% of businesses plan to obtain financing in 2016

52% of businesses planned to obtain financing in 2015

61% of small businesses plan to take out a loan of $100K or less this year. Here are the top factors they will consider when choosing a lender:

50% said the rates

32% said they trust the lender

14% said the ease of the application process

4% said technology

Companies considering loans of 100K or less plan to use those funds for a variety of reasons:

19% said to either buy or repair equipment

18% said to purchase inventory

15% said for expansions

15% said for software and technology

For 2016, hiring projections remain similar to the previous three years.

36% expect to increase employee compensation

31% expect to increase the number of part-time employees

25% expect to increase the number of full-time employees

The use of mobile technology to manage business needs is on the rise from last year; this is particularly true of larger revenue companies.

37% manage business finances/banking via mobile devices

31% make payments via mobile devices

23% accept credit card payments via mobile devices

21% of companies have a dedicated mobile website

12% of companies have an app for mobile devices

The majority of companies accept either chip-enabled EMV cards or NFC (contactless) payments, with nearly half accepting chip-enabled cards.

Among companies not currently using chip-enabled EMV technology, one in three plans to obtain card readers in the next three years.

Accepts EMV or NFC:

63% larger revenue companies

58% smaller revenue companies

59% overall

Accepts EMV cards:

50% larger revenue companies

47% smaller revenue companies

48% overall

All rights reserved. Chase and J.P. Morgan are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries. The material contained herein is intended as a general market commentary, in no way constitutes J.P. Morgan research and should not be treated as such. Further, the information and any views contained herein may differ from that contained in J.P. Morgan research reports.

JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender

© 2016 JPMorgan Chase & Co.

© JPMorgan Chase & Co. all rights reserved.

Business Leaders Outlook Spring/Summer 2016